Climate Change

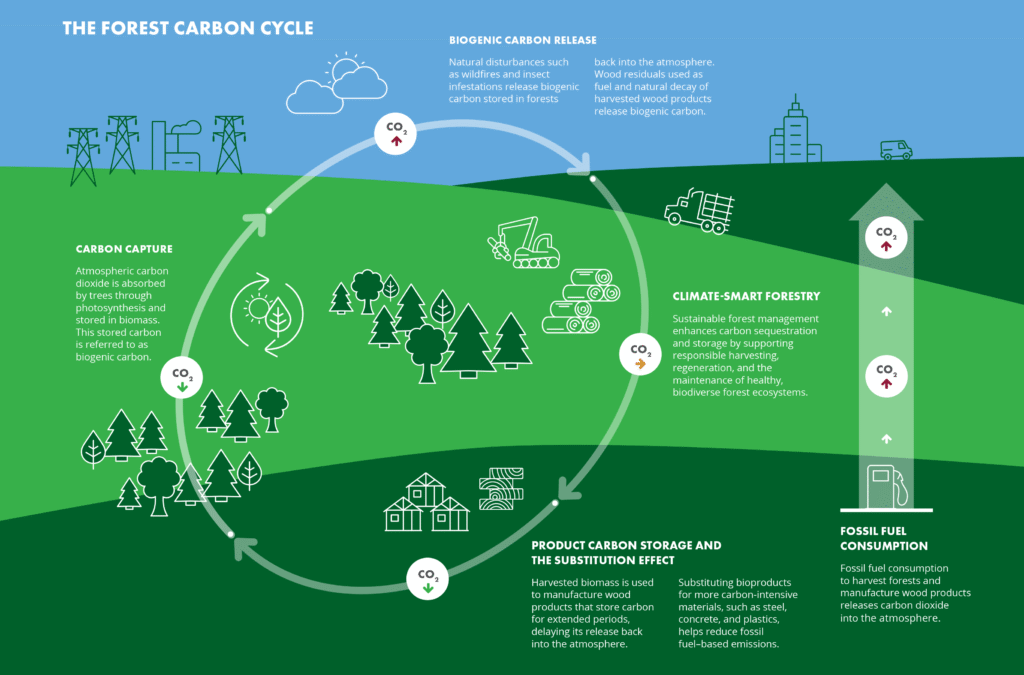

Our support of and participation in global climate initiatives underlines our commitment to the environment, our industry, and our business. In an effort to reduce impacts on the environment and mitigate the risk from climate change, we are boosting our use of renewable energy, promoting carbon sequestration and investing in technological innovations such as the use of cross-laminated timber in the construction industry.

MERCER’S CLIMATE TRANSITION PLAN

Mercer has a Climate Transition Plan that outlines our strategy and commitment to GHG emissions reductions in our own operations and our value chain. Our Climate Transition Plan is our company-wide climate change strategy and it includes collaborating with our value chain partners, developing low-carbon products, and adapting to the physical impacts of climate change. We conduct regular climate scenario analyses to assess climate-related risks and opportunities. Through this process, we assess the resilience of our business strategy and model against different potential future climate scenarios. We recognize that in order to meet our greenhouse gas emissions targets, it will be crucial to focus on upgrading key existing infrastructure, such as our lime kilns, with technological advancements that allow us to reduce our reliance on fossil fuels.

Aligning our climate ambitions with a future where warming is limited to 1.5°C above pre-industrial levels, our Climate Transition Plan is framed around the CDP’s key elements of a credible plan. It involves a companywide integrated strategy that addresses where we are today and where we need to be in the future to be successful in a 1.5°C world.

PATH TO 2030

Chief Financial Officer and Secretary

OUR CLIMATE TRANSITION PLAN INCLUDES:

SCENARIO ANALYSIS

Mercer incorporates Climate Scenario Analysis as a fundamental part of our overall risk management approach. This analysis is conducted periodically and adheres to the guidelines of the Task Force on Climate-Related Financial Disclosures (TCFD). By modeling potential future scenarios, we gain deeper insights into the associated climate-related risks and opportunities, including potential financial impacts, and are able to enhance the resilience of our business strategy.

RISKS AND OPPORTUNITIES

Mercer’s Climate Scenario Analysis identified key risks and opportunities across three different potential warming scenarios identified with guidance from the Intergovernmental Panel on Climate Change and the Network for Greening the Financial System. These risks include physical risks, such as extreme weather events, water scarcity, and disruptions to fiber supply, and transition risks, including shifting regulations and increased competition for land use. By proactively adjusting our strategy, we are working to anticipate regulatory and societal changes that may affect our business and strengthen the resilience of our supply chain. For more information, please see Mercer’s TCFD Content Index on our website.

TARGETS

Our GHG emissions reduction strategy starts with science-based target setting followed by focusing on actions with the greatest potential for emissions reductions. Climate science underscores the need for immediate action: to prevent the worst effects of climate change, global warming must be limited to 1.5°C, emissions must be cut in half by 2030, and net zero must be achieved by 2050. Mercer is committed to playing its part in this critical transition. In 2021, Mercer set initial climate goals, committing to a 35% reduction in scope 1 GHG emissions per tonne of pulp by 2030, along with a 35% absolute reduction in scope 2 and 3 emissions from a 2019 baseline. These near-term targets were validated by the Science Based Targets initiative (SBTi). During 2024, to align with a 1.5°C pathway, we increased our ambition to a 50% reduction in pulp mill scope 1 GHG emissions intensity. Mercer has acquired several additional businesses (e.g. sawmill and mass timber facilities) since our initial scope 2 and scope 3 climate targets were set. As a result, Mercer increased the comprehensiveness of our scope 2 and 3 absolute emissions measurements to account for acquisitions and set a revised baseline year of 2024 with a 35% reduction target. Our scope 1 emissions intensity target is integrated into our Short-Term Incentive Plan compensation as part of aligning our core values with our incentive structure.

OUR SBTI COMMITMENT

In 2022, Mercer became one of the first North American companies in the forest and paper products sector to have its climate targets validated by the Science Based Targets initiative. As the global economy undergoes a transition to net zero, we recognize that 1.5°C-aligned businesses will be best positioned to succeed in a low carbon future. As such, we are working toward re-validating our revised targets aligning with limiting warming to 1.5°C.

LOWER CARBON INITIATIVES AND PRODUCTS

Our manufacturing facilities are primarily powered by self-generated on-site renewable energy, and the carbon intensity of our purchased electricity is continuing to decline. To minimize scope 3 emissions, we are continuing to focus on lowering the emissions of our logistics through partnering with our logistics providers to shift product transport from trucking to rail and to further improve efficiency.

VALUE CHAIN ENGAGEMENT

Mercer engages closely with customers to help realize their sustainability goals and climate ambitions. We also work with government policy makers as well as industry associations to support the forest bioeconomy. We Realize that some of our sustainability and climate goals are linked to the actions of our suppliers, and we engage with them in areas such as sustainable forest management and chain-ofcustody certification.

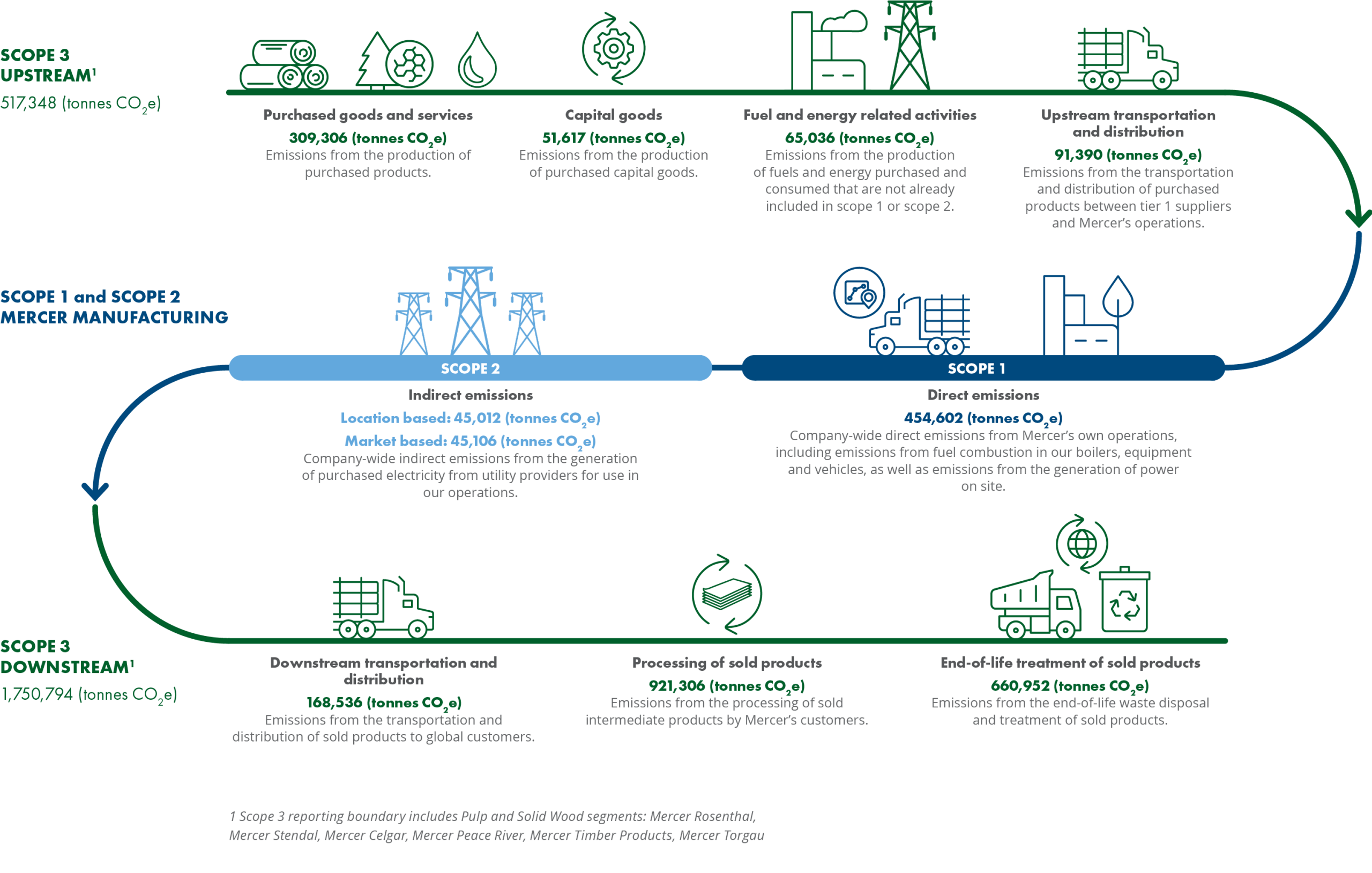

SCOPE 1, 2, AND 3 ACCOUNTING

Accurate and reliable data is essential for tracking progress and setting meaningful targets. We measure and report our GHG emissions annually across our value chain and work to continuously improve data quality and accessibility. Our GHG inventory calculations are aligned with the GHG Protocol using an operational control approach. We have obtained third-party assurance for all three scopes of emissions in order to ensure reliability and transparency.

NEXT STEPS

As we strengthen our climate ambitions to align with a 1.5°C pathway, we recognize the SBTi requirement for land-intensive industries to set near-term targets for indirect Forest, Land, and Agriculture (FLAG) emissions. FLAG targets are designed to account for and drive reductions in greenhouse gas emissions stemming from land use change, land management, and carbon removals. In response, we plan to measure our FLAG emissions in 2025, update our scope 1, 2, and 3 emissions reduction targets accordingly, and obtain SBTi re-validation. Setting separate targets for FLAG emissions allows us to better track our different emission sources to enable more targeted management strategies. Measuring our FLAG emissions will involve building on previous work done in 2021 as part of Mercer’s Alberta Climate Impact Assessment to complete a FLAG baseline including land use change, land management, and carbon removals.

Our Climate Transition Plan reflects our commitment to doing our part to address the climate crisis by integrating climate mitigation and adaptation across our operations, supply chain and decision-making. We are expanding our low-carbon product portfolio and adapting to an evolving landscape. This is a work-in-progress. We will continue to refine our approach to align with global standards, market needs, and the latest climate science.

We are also excited to further evaluate biogenic carbon capture technology to further increase our role in mitigating climate change.

Mercer’s renewable resources present great opportunities to substitute fossil-based inputs and materials, such as plastics, with fiber-based solutions from sustainably managed forests.

CUSTOMER ENGAGEMENT

Reducing GHG emissions is essential not only for environmental reasons but also to help Mercer and our customers achieve 2030 climate mitigation targets.

Our approach to our 2030 sustainability objectives is characterized by transparency and active engagement with customers to determine what is most material to them. By participating in the SBTi and reporting our sustainability practices to globally recognized platforms like EcoVadis and CDP, Mercer also provides customers with comprehensive climate-related information along our value chain. This enables our customers to make informed decisions that align with their sustainability goals.

KEY CUSTOMER INTERESTS

Chief Sustainability Officer

CLIMATE SCENARIO ANALYSIS

Mercer recently completed its third climate scenario analysis in partnership with Business for Social Responsibility (BSR) in 2024, building upon previous analyses conducted in 2020 and 2022. This ongoing collaboration with BSR has allowed Mercer to progressively enhance its understanding of climate-related risks and opportunities. Through a series of workshops with Mercer’s senior leadership, including sessions focused on identifying and validating key risks and opportunities, as well as developing strategic management initiatives, BSR worked closely with Mercer to refine its approach. This latest analysis further strengthened Mercer’s climate resilience and strategic decision-making by providing detailed asset-level physical climate impact assessments utilizing GIS mapping and hazard analysis and classifying financial impacts using a framework aligned with Mercer’s Enterprise Risk Management process and Double Materiality Assessment. Additionally, BSR’s work included an evaluation of Mercer’s existing mitigation policies and actions, identification of indicators to assess the effectiveness of programs, and development of actionable recommendations to further improve resilience, all while ensuring alignment with evolving CSRD reporting requirements such as European Sustainability Reporting Standards (ESRS) E1. This collaborative process has enabled Mercer to continuously integrate climate considerations into its strategic planning and management activities, reinforcing its commitment to addressing climate-related challenges and opportunities.

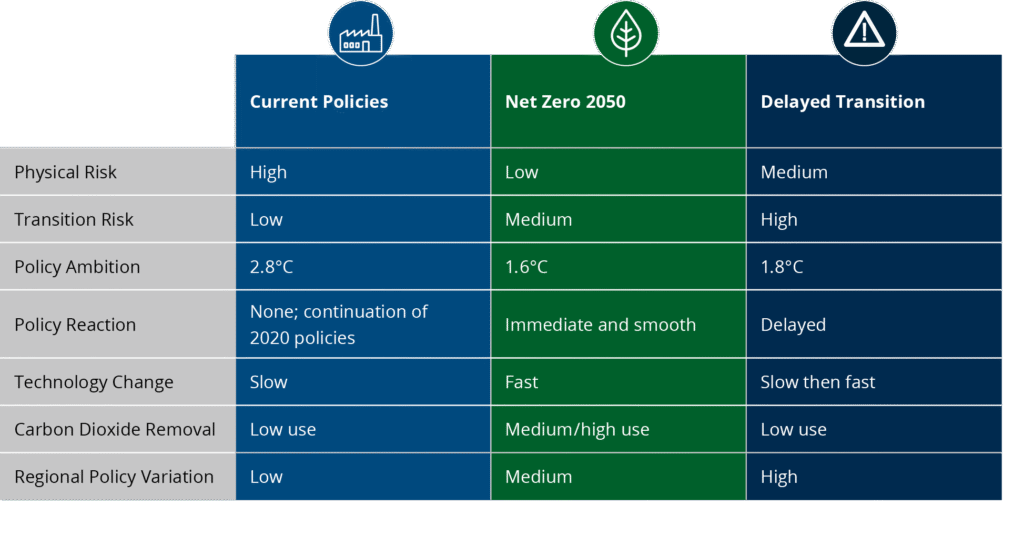

We explored three ranges of possible future scenarios with guidance from the Intergovernmental Panel on Climate Change (IPCC) and the Network for Greening the Financial System (NGFS).

Current Policies: Only currently implemented policies are preserved leading to high physical risks. This scenario is characterized by absent ambitious government or business action, slow technology change, low use of carbon dioxide removals, and low regional policy variations. The result is emissions on track to reach 2.8°C warming by 2100 (Representative Concentration Pathways (RCP) 4.5).

Net Zero 2050: The transition to a net-zero economy required drastic and coordinated global action beginning in the 2020s. This scenario is characterized by immediate policy action, rapid technology change, medium-high carbon dioxide removals, and medium regional policy variations. The cost of action is initially high but warming peaks at 1.6°C in 2060 and declines to 1.4°C by 2100 (RCP 1.9).

Delayed Transition: After a decade of inaction, a set of uncoordinated and stringent policies are adopted in the 2030s to rapidly halt greenhouse gas emissions. This scenario is characterized by delayed policy action and technology change, low-medium carbon dioxide removals, and high regional policy variations. High social and economic costs result in warming peaking at 1.8°C, but ultimately declines to 1.6°C by 2100 (RCP 2.6).